Unconditional Commitment

Unlike other financial planning firms, we do not receive commissions. Our fee-only philosophy ensures that only the most appropriate financial products and strategies will be selected to suit your unique situation and profile. We represent you, not the financial services industry.

The SK Way

Fee-Only

Investing with SKWealth

SKWealth is compensated by fees only. We do not receive any compensation from commissions or other transaction charges. For the management of investment portfolios, our fees are based on the assets under management.

SKWealth focuses on tailored strategies for portfolios with a suggested minimum of $1,000,000 in assets under management among all accounts.

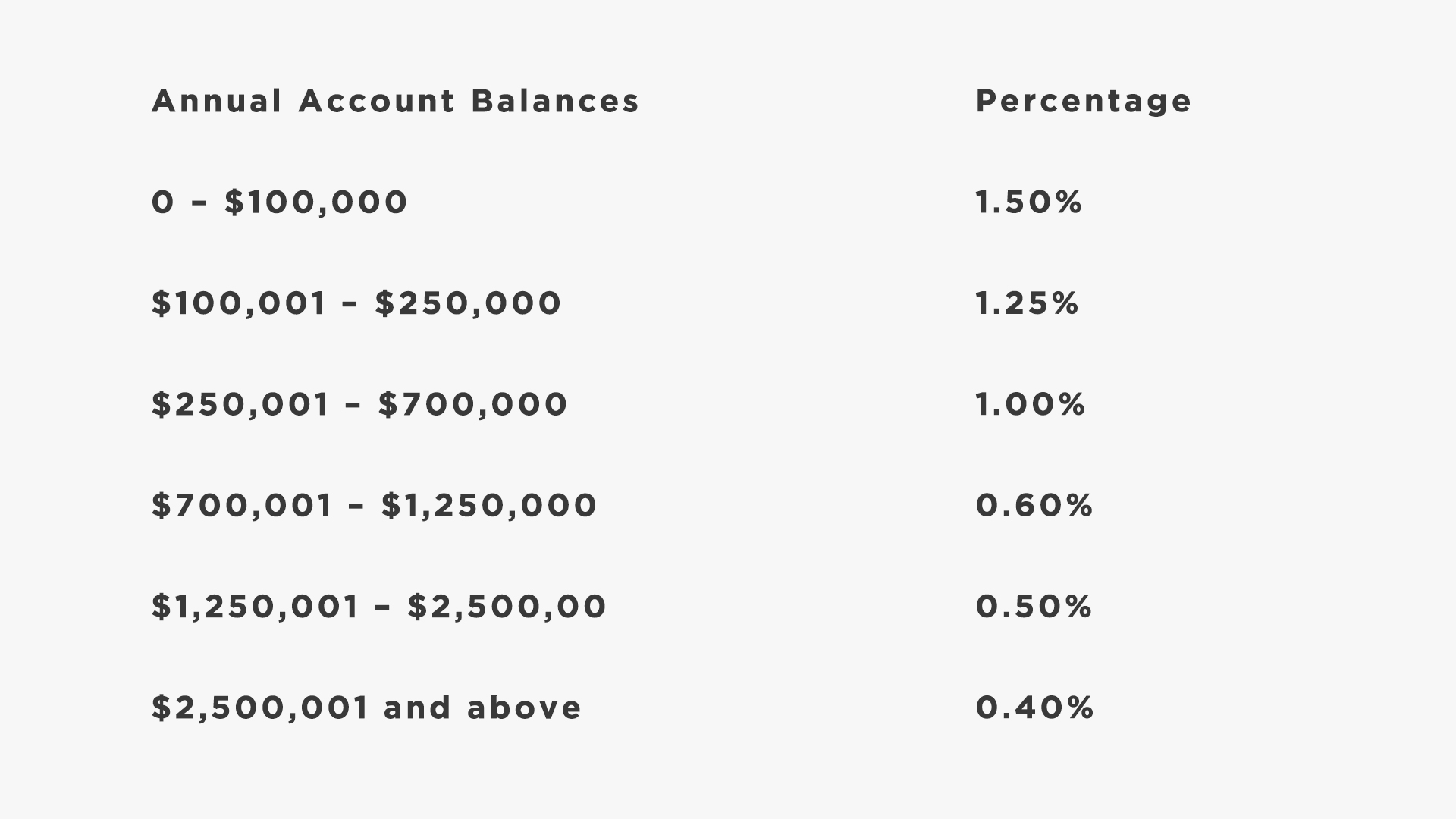

Fee Schedule

Fees are rarely negotiable and are invoiced quarterly (in arrears) and deducted from clients’ accounts (clients may elect to be billed quarterly in arrears) per the following schedule:

Annual Account Balances

0 – $100,000

$100,001 – $250,000

$250,001 – $700,000

$700,001 – $1,250,000

$1,250,001 – $2,500,00

$2,500,001 and above

Percentage

1.50%

1.25%

1.00%

0.60%

0.50%

0.40%

The above is a tiered fee schedule. This means that, depending on a client’s asset level, the client may be subject to multiple fee tiers. For example, a client with assets in the amount of $1,500,000 would be subject to an annual fee rate of 1.5% on the first $100,000, 1.25% on the next $150,000, 1% on the next $450,000, 0.6% on the next $550,000 and 0.5% on the remaining $250,000.

The SK Way

Fee-Only

Investing with SKWealth

SKWealth is compensated by fees only. We do not receive any compensation from commissions or other transaction charges. For the management of investment portfolios, our fees are based on the assets under management.

Fee Schedule

Fees are rarely negotiable and are invoiced quarterly (in arrears) and deducted from clients’ accounts (clients may elect to be billed quarterly in arrears) per the following schedule:

The above is a tiered fee schedule. This means that, depending on a client’s asset level, the client may be subject to multiple fee tiers. For example, a client with assets in the amount of $1,500,000 would be subject to an annual fee rate of 1.5% on the first $100,000, 1.25% on the next $150,000, 1% on the next $450,000, 0.6% on the next $550,000 and 0.5% on the remaining $250,000.

Our Approach

Towards Sustained Prosperity

Our approach comprises of a combination of both active and passive management. This is the most beneficial approach for portfolios — especially when considering the growth of advanced indexes. Additionally, both management techniques can complement each other within asset classes and allow investors to tilt portfolios to the best opportunities within and across markets.

As a result, SKWealth clients can expect that we strive to build the most cost-effective, resilient, and robust portfolios possible.

Sustainable + Impact Investing

ESG

We offer a wide range of investment options for our clients. This includes sustainable and impact investing that incorporates environmental, social, and governance (ESG) criteria. We identify well-managed companies with the strongest demonstrated performance in areas of environmental sustainability, social responsibility, and corporate governance.

With over 23 years of experience, Matthew M. Neyland, CFA, CAIA, Chief Investment Officer oversees all of SKWealth’s investment management activities — offering expertise on a wide variety of investment security types including equities, fixed income, and alternative assets.

On the Road Together,

at Each Step of the Process

At SKWealth, we subscribe to various sources that supply us with hundreds of benchmark measures, performance figures for all investment types (mutual funds, ETFs, stocks, bonds, etc.) along with various risk measures. We also design custom benchmarks to meet each individual client’s unique risk/return profile.

Performance Reports

- Quarterly or on-demand

- Electronic and secure

- We have daily access to transaction and price data

- Clients receive monthly statements directly from the custodian

Rate of Return Calculations

- Available for any desired period

- Summaries of activity for the period

- Comparison of investment positions to a client’s documented allocation policy

- Client portfolios are formally reviewed by SKWealth at least once a month