After a year marked by political uncertainty and market swings, even savvy investors have been left wondering what comes next. It’s a valid question – some things changed in 2025 in ways we haven’t seen in over a decade.

The good news is that the opportunity set is expanding. Success is becoming less dependent on a narrow slice of U.S. markets and more reliant on thoughtful diversification across regions, sectors, and income strategies.

In this post, we’ll walk through what happened in 2025, what’s changing in 2026, and how to position your portfolio for what comes next.

Market Overview

What defined markets in 2025?

- Strong corporate earnings drove U.S. stock performance

- International markets outperformed the U.S. for the first time in 15 years

- U.S. bonds delivered their best returns since 2020

How should investors position portfolios for 2026?

- Diversify across regions, not just U.S. markets

- Increase income generation from fixed income

- Add inflation hedges and infrastructure investments

- Look beyond U.S. Treasuries to emerging market bonds

- Prepare for continued episodic volatility

What Happened in 2025: Looking Back at a Volatile Year

Markets Were Driven by Fundamentals

Strong corporate earnings remained the primary driver of equity returns throughout 2025. While political events created short-term volatility, they had limited lasting impact on market performance. Investors who stayed focused on company fundamentals rather than news cycles were rewarded.

International Markets Outperformed the U.S.

For the first time in 15 years, international equities outpaced U.S. markets. This signals a meaningful change in global market dynamics that’s worth paying attention to. Three key factors drove this shift:

- Stronger earnings growth in international companies compared to their U.S. counterparts.

- Government stimulus programs in Europe and Asia that supported economic activity.

- Currency appreciation that provided additional tailwinds for U.S. investors holding international assets.

Bonds Had Their Best Year Since 2020

The U.S. bond market delivered strong performance as interest rates trended lower throughout the year. Falling rates boosted fixed income returns across most sectors.

Keep in mind that this trend is unlikely to repeat in 2026. Interest rates have less room to fall, and other factors are creating headwinds for traditional bond strategies.

Understanding the K-Shaped Economy

There’s been increasing discussion in economic circles about a “K-shaped” economy, and the data supports it. This concept affects how we think about portfolio construction and risk.

What a K-Shaped Economy Means for Investors

A K-shaped recovery describes a post-crisis period where different parts of the economy perform at sharply diverging rates, forming two arms of the letter K. One arm trends upward while the other trends downward.

The “Upper Arm” of the K

The upper arm includes sectors, companies, and people benefiting from the recovery. In many cases, they’re wealthier than before the pandemic:

- Technology stocks and big tech companies

- Luxury goods sectors

- High-income professionals

- Asset owners and investors

The “Lower Arm” of the K

The lower arm includes sectors and households that continue to decline or stagnate even as the overall economy appears to improve:

- Hospitality and travel industries

- Lower-priced retail outlets

- Low-wage service workers

- Small businesses and farms

- Middle-class and lower-income households

We’re watching this closely. Farm and small business bankruptcies have increased substantially, and consumer delinquencies are trending higher. These are warning signs that parts of the economy remain under stress.

The Risk of Stagflation

This divergence creates potential an environment combining slowing economic growth with persistently high inflation. We refer to this as stagflation. It’s a challenging situation that requires different portfolio construction than what worked in previous decades.

We’ve prepared for this reality by increasing income generation from fixed income investments and implementing hedging strategies designed to protect purchasing power.

The Labor Market, Tariffs, and Inflation Pressures

The Job Market as a Leading Indicator

The labor market is showing clear signs of weakness. The U.S. economy has barely added any jobs since April of 2025. The unemployment rate is trending higher and hourly wage rates are steadily falling.

This will influence Federal Reserve policy decisions and it signals potential economic slowdown ahead.

Tariffs and Business Uncertainty

Businesses became understandably cautious right after tariff announcements in April. Companies are now forced to plan for uncertain futures during a period of unpredictable policy.

Many have responded by freezing hiring and reducing their forecasting windows. This uncertainty creates drag on economic activity and makes business planning more difficult.

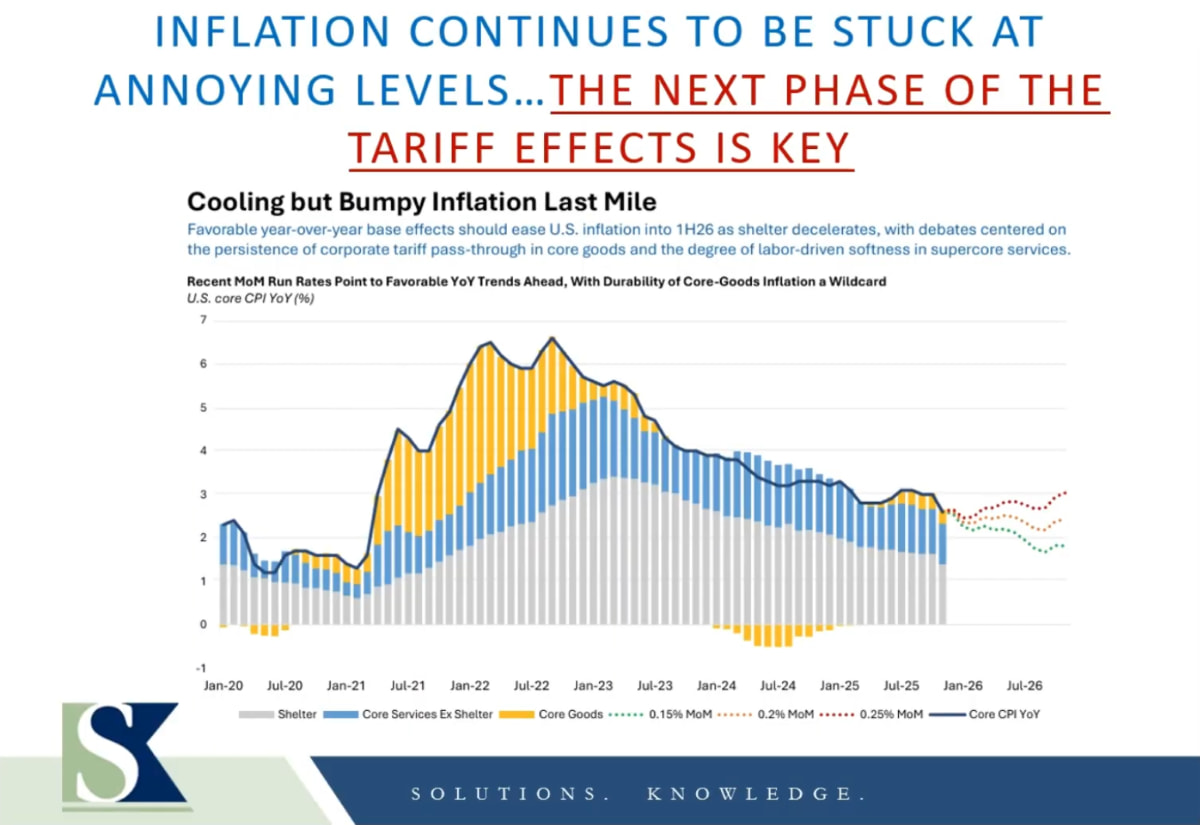

Why Inflation Remains a Concern

Inflation has fallen from its peak but remains elevated at levels that are higher than what we experienced in the decade before the pandemic. Don’t be fooled by some of the more benign inflation reports.

Companies took specific measures to combat inflation in 2025. We saw massive import volumes as businesses tried to get ahead of tariffs, and companies absorbed about 70% of the tariff impact rather than passing it on to consumers.

What’s Changing in 2026

That import front-loading effect is fading, and many companies have announced they will begin passing most tariff costs on to consumers. This means inflation pressures are likely to persist or even increase.

There is some hope on the tariff front. The Supreme Court is set to rule on the legality of tariffs, and over a thousand companies have sued the government. However, the Trump administration has indicated they may have workarounds to maintain tariffs regardless of court rulings.

This uncertainty is why we’ve positioned portfolios with additional hedging strategies and increased income generation. Bonds alone are not the best inflation hedges.

Portfolio Positioning for Inflation and Volatility

Why Bonds Alone Are Not Enough

Traditional fixed income has limitations as an inflation hedge. When inflation runs hot, bond returns often lag, and purchasing power declines.

This doesn’t mean bonds have no role in portfolios. It means they need to be complemented by other strategies.

Income and Hedging Strategies

We’ve increased portfolio income through diversified fixed income allocations that go beyond traditional U.S. Treasuries. We’ve also implemented hedging strategies specifically designed to protect purchasing power during periods of elevated inflation.

The goal is to prepare portfolios for multiple economic scenarios rather than betting on a single outcome.

Energy Demand, Infrastructure, and Global Opportunity

The Return of Rising Electricity Demand

From 1950 to 2006, U.S. electricity generation grew by 2% to 4% each year. During that era, 70% to 90% of new capacity came from a small number of large coal, nuclear, and gas plants. But after 20 years of flat electricity demand, the U.S. now needs to meet surging new demand from:

- Data centers supporting artificial intelligence and cloud computing

- Electric vehicles and charging infrastructure

- Electrification of commercial, industrial, and residential heating

Structural Challenges in Energy Supply

Maintaining the same pace of capacity additions today is challenging. Shortages of skilled energy labor and increased regulatory scrutiny of energy projects are creating bottlenecks.

Can governments move quickly enough to meet demand? As of right now, that’s an ongoing question with no clear answer.

Private Sector Innovation and Investment

It’s important to know that some companies aren’t waiting on the government. They’re working on funding their own energy solutions and investing in new technologies.

Markets around the globe are affected by this issue. It’s why we’ve added infrastructure investments to portfolios. The buildout required to meet these structural changes will take decades and create sustained investment opportunities.

Changes to Fixed Income in 2026

Why U.S. Bonds Are Facing Headwinds

We’re forecasting lower returns this year, as interest rates won’t fall as much as they did in 2025. The Federal Reserve expects to cut rates once in 2026, most likely in the second half of the year. Bond investors and strategists are expecting two to three cuts, but even that would be far less support than what we saw last year.

Additionally, continuing fiscal pressures are causing governments to issue substantial amounts of debt for funding needs. Corporations are expected to issue a record amount of debt in 2026. This supply alone will be a headwind and keep intermediate and long-term interest rates anchored at higher levels.

This is why we currently don’t have many U.S. Treasuries in portfolios.

Looking Beyond U.S. Treasuries

Globally, interest rates have shifted significantly. Many international markets are now offering yields that are very competitive with the U.S.

The Case for Emerging Market Bonds

Emerging markets are offering some of the best yields available. In many cases, emerging market economies have less debt than developed nations and benefit from rising currencies.

This is why we expanded our emerging market bond allocation throughout 2025. We’ve coupled that with other components and regions of the fixed income markets to accomplish three main goals for our non-stock allocations:

- Reduce downside risk during market volatility.

- Enhance diversification beyond traditional U.S. fixed income.

- Generate higher income to support portfolio returns.

Corporate Earnings Outlook and Global Growth Drivers

Earnings Expectations for 2026

Macroeconomic conditions are generally favorable and will provide a positive backdrop for corporate earnings in 2026. Government spending is fueling industrial activity, and the new tax bill favors corporations.

Regional Earnings Growth Trends

Consensus earnings estimates show diverging growth rates by region:

- Emerging markets are expected to enjoy the strongest earnings growth at 17.2%.

- United States earnings are expected to rise just over 14%.

- Europe is projected to grow slightly above 11%.

Key Global Tailwinds

Several specific developments are supporting international market growth. These are some of the reasons we increased our international allocation last year. We see this as a longer-term trend, not a one-year phenomenon.

Germany’s infrastructure stimulus is roughly 12% of the country’s GDP and aimed at boosting growth, spurring competitiveness, and strengthening regional security. These initiatives provide opportunities for industrial companies and software developers.

Improving corporate governance in Japan and other Asian countries is providing a tailwind as companies adopt structural reforms and shareholder-friendly initiatives like accelerating share buybacks and paying higher dividends.

We see the long-term implications to trade that will also benefit international companies and countries. The U.S. tariff policies have made it harder to do trade with the U.S. by adding costs and logistical hurdles. The international regions have responded by seeking new trade partners that are easier to deal with and can help reduce costs. This has long-term implications because once these new trading relationships are established, they are hard to unwind. As an investor we see it greatly improving the profitable of companies outside the U.S.

Preparing for What Comes Next

We’re predicting various tailwinds that should drive earnings growth and support market gains beyond just the technology sector. But ultimately, what’s going to matter is corporate fundamentals and earnings growth.

Why Episodic Volatility Is Becoming More Frequent

The global geopolitical and economic climate is changing at a faster pace than in previous decades. Policy shifts, trade disputes, and geopolitical tensions create more frequent periods of market volatility.

These episodes don’t necessarily signal the start of bear markets. They reflect the reality of investing in a more interconnected, rapidly changing world.

The Importance of Scenario Testing

We’ve adapted and enhanced our scenario testing capabilities to do the most important thing in investing: prepare ahead of time for what happens next.

This means stress-testing portfolios against multiple potential outcomes and avoiding only having a single path forward.

Final Thoughts: Opportunity Through Preparation

We’re excited about the expanded opportunity set in the financial markets. The shift away from U.S.-centric portfolio construction toward broader global diversification creates new ways to manage risk and capture returns.

But we’re also aware that market pullbacks will occur. Volatility isn’t going away. In fact, it’s only becoming more frequent as the pace of change accelerates.

Success in 2026 and beyond will depend on fundamentals, disciplined rebalancing, and portfolios built to weather multiple scenarios.

At SK Wealth, our financial advisors have been helping clients navigate complex market environments for 25 years. Through our Integrated Financial Advantage™ process, we create personalized recommendations that adapt to changing conditions while staying aligned with your long-term goals. We understand that markets shift, policies change, and economic cycles evolve. Your financial plan should provide clarity and confidence through it all.

Important Disclosure Information

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by SK Wealth Management, LLC [“SK Wealth”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, no portion of this discussion or information serves as the receipt of, or a substitute for, personalized investment advice from SK Wealth. contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from SK Wealth. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Neither SK Wealth’s investment adviser registration status, nor any amount of prior experience or success, should be construed that a certain level of results or satisfaction will be achieved if SK Wealth is engaged, or continues to be engaged, to provide investment advisory services. SK Wealth is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the SK Wealth’s current written disclosure Brochure and Form CRS discussing our advisory services and fees is available for review upon request or at https://skwealth.com/. Please Note: SK Wealth does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to SK Wealth’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a SK Wealth client, please contact SK Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.